A company with a high debt-to-equity ratio may be more vulnerable to economic downturns and may struggle to make debt payments. Areas to pay attention to include the debt-to-equity ratio, which measures a company’s debt relative to its equity. Investors should examine a company’s debt levels to determine if they are sustainable and manageable. These metrics can have a significant impact on a company’s financial health. The investment is not a no-brainer, because everyone can understand that paying close to 30x forward earnings for a business whose bottom line is growing at roughly half of that, is not a cheap valuation.Trevor Rose’s Insights - Trevor’s most-liked answers from 5i Research.īasic Investing Metrics: Debt and Leverage. Obviously, that's not a cheap valuation.īut as you know extremely well, you don't get high-quality compounders cheaply. The more nuanced analysis would be quick to remark that investors are being asked to pay around 27x next year's EPS (ending June 2024). The rapid takeaway here is that Microsoft is still in growth mode, being led by AI.

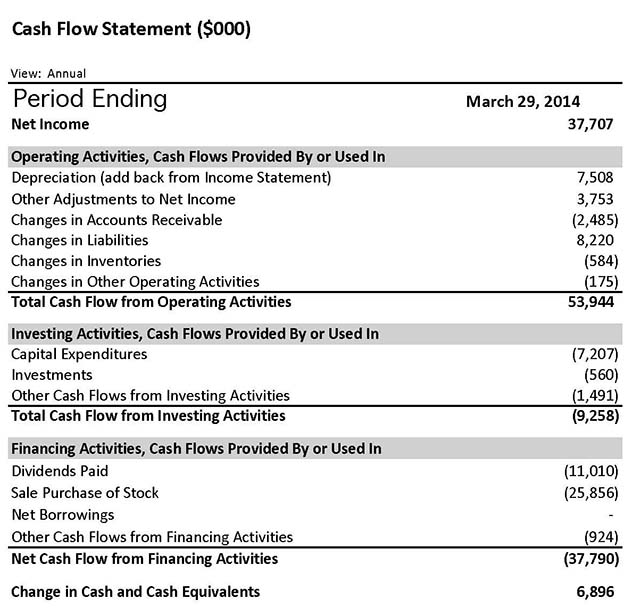

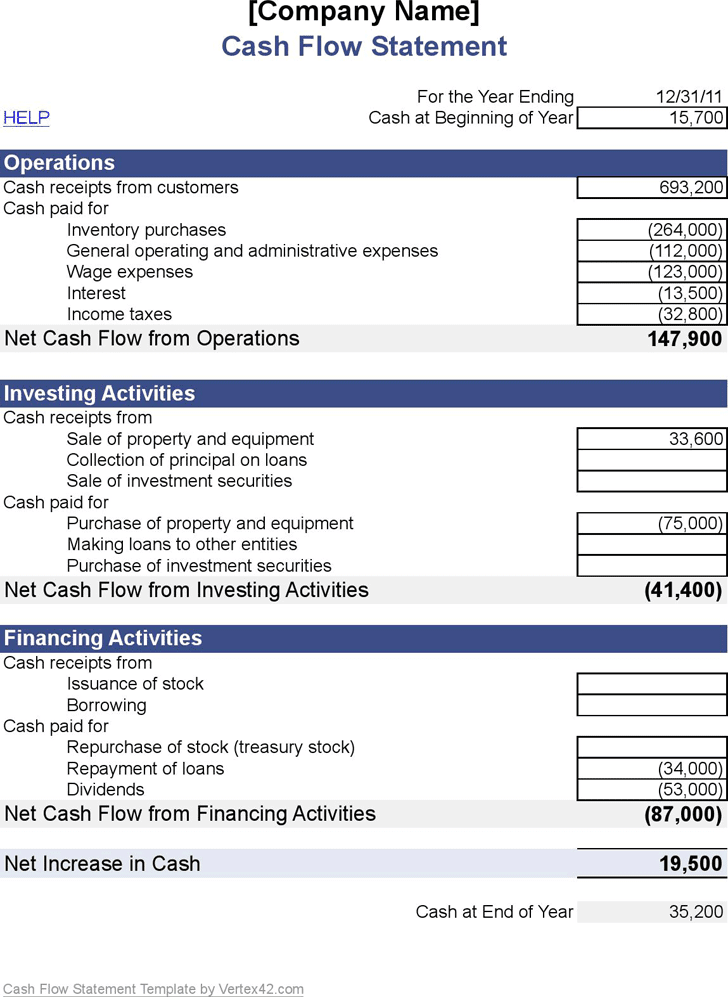

MICROSOFT CASHFLOWS 10K FREE

Put another way, out of every $1 of revenues, Microsoft takes out of the business 33 cents of cash.Īnd unlike other tech businesses where management is taking home all that free cash flow as stock-based compensation, 85% of Microsoft's free cash flow is ''actual free cash flow'', after stock-based compensation, for shareholders. More specifically, Microsoft's free cash flow margins reached 33%. Rather, because of its ability to print impressive free cash flows. Why is Microsoft one of the most valuable companies in the world? Not because of its ability to spin a carefully woven narrative. I believe that in the coming few days, we'll see countless analysts upwards revising Microsoft's price targets. Since the start of 2023, analysts had been steadily downgrading Microsoft's consensus revenues, at the same time as investors were clamoring for its stock. Case in point, consider the path that analysts had been facing as we headed into the earnings results. Investors had been fearing that Microsoft's growth rates would be grinding to a halt. Microsoft took investors by surprise with its solid guidance for the quarter ahead.

Revenue Growth Rates, Still in Growth Mode Again, nuance matters, which we'll discuss in the next section. It appears that Wall Street's narrative didn't line up with the facts. At a time when we are being told that employees were returning back to the office and that the Work From Anywhere element of working was retracing. Presently, Teams reached an all-time high. Teams usage is at an all-time high and surpassed 300 million monthly active users this quarter, and we once again took share across every category from collaboration to chat to meetings to callingĬonsider the quote above. The message was abundantly clear, that 2023 is shaping up to resume the cloudification and digitalization of businesses. But the takeaway from the earnings call was more than just silver narratives over AI's future prospects.

Microsoft's CEO Satya Nadella started the earnings call by whetting investors' appetite toward Microsoft's next wave of growth, Azure OpenAI Service. That detail and nuance matter again in investing.įrom Coursera and Grammarly to Mercedes-Benz and Shell, we now have more than 2,500 Azure OpenAI Service customers, up 10x quarter-over-quarter. To put it another way, throughout 2023 we've all heard that 2023 is the ''Year of the Stock Picker'' and I believe Microsoft's outperformance after hours goes some way to reaffirm that assertion. Not only does this show that Microsoft's growth engine is still intact.īut on top of this, it has a multiplier effect that highlights that despite all the investor concerns about the IT segment seeing a slowing down in IT spend turns out not to be quite as accurate as many had presumed. For investors, this was absolutely terrific news. Microsoft's Intelligent Cloud segment takes the limelight again. AI Prospects, the Showdown? Tune in For the Next Episode The message from these earnings results was clear, Microsoft isn't seeing the dreaded slowdown in IT spend. Masterfully, Microsoft came out to show a ''little leg'' of its prospects around AI but was quick to resume to remind investors that there's a lot more to Microsoft than future prospects around AI. And as you'd expect investors and analysts were eagerly listening to every word and nuance of the earnings call with bated breath. Microsoft ( NASDAQ: MSFT) had been buzzing since the start of 2023 for being a pioneer in its partnership with OpenAI.

0 kommentar(er)

0 kommentar(er)